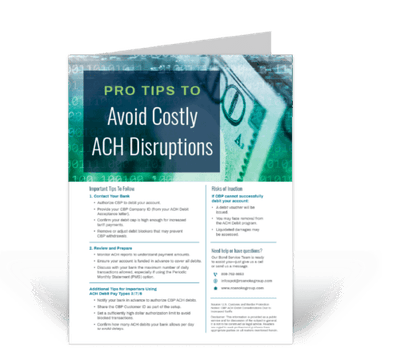

Avoid Costly ACH Disruptions: What Importers Must Do Now

ACH stands for Automated Clearing House, an electronic network used for processing large volumes of financial transactions. In the context of U.S. Customs, it allows importers to pay duties, taxes, and fees directly from their bank accounts via authorized debits by Customs and Border Protection (CBP).

With rising tariffs, your U.S. Customs duty payments through ACH Debit may now exceed your current bank limits. This can lead to failed payments, penalties, or even removal from the ACH Debit program.

Other Resources

Avoid Costly ACH Disruptions: What Importers Must Do Now

Cómo gestionar los requisitos financieros y el cumplimiento

Guiar al Importador por los Obstáculos de la Suficiencia de la Fianza

CARM and RPP FAQ Sheet

NAFTZ Member Bonds and Insurance

Navigating Financial Requirements & Compliance for Customs Bonds