August 23, 2024 | Customs Bonds

Save Money and Avoid Delays: Expert Tips for Customs Bond-Compliance

Written by Colleen Clarke, SVP, Surety Trade Relations and Business Development

Driven by the onset of the trade remedy tariffs in Spring 2018, duties owed on imported goods more than doubled and continue to grow, especially due to by additional duties on goods imported from China.

A Surge in Duties, Taxes, and Fees

According to Customs and Border Protection’s (CBP) Trade Statistics, the total amount of duties, taxes and fees collected in FY 2023 was $92.3 billion. This was a 17.46% decrease from FY 2022, however the amount of duties, taxes and fees increased over 220% compared to FY 2018. The value of goods imported decreased slightly in FY 2023, with the number of entries down as well.

The Effect on U.S. Customs Import Bonds

The impact of these additional duties has a direct impact on U.S. Customs Import Bonds, as the bond amount calculation is 10% of the total duties, taxes, and fees an importer has paid in the last 12 months (subject to certain rounding rules and a $50,000 minimum bond amount). As trade remedy tariffs continue, the additional duties owed will likely increase, causing many importers to need a larger bond.

Rising Bond Insufficiency Notices

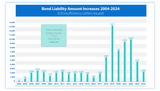

Since the introduction of Trade Remedy tariffs in 2018, we have seen an unprecedented rise in bond insufficiency notices sent out by CBP. The chart above shows the number of CBP-mandated bond insufficiency letters issued each calendar year (2024 through June). While the number has cooled in the most recent years, the expiration of many exemptions from these tariffs should once again cause an upswing in insufficiencies. CBP requires a short timeline to initiate the replacement of an insufficient bond: just 15 days after the date of the letter, the termination of the bond on file must be received by CBP.

The Importance of Understanding Customs Bond Obligations

Many of the notices are for principals who have already had at least one bond increase since the inception of the increased tariffs.

It’s important for importers to understand their Customs Bond obligations. Maintaining a sufficient bond is an informed compliance requirement, but it often falls to the surety agent and the customs broker to guide the importer towards a proper bond amount.

The Risks of Stacking Liability

Many importers don’t understand the ramifications of needing to increase their bond amount multiple times. Having more than one bond in a year creates a “stacking liability” or aggregate liability issue for both the surety and the importer.

A bond is a financial guarantee. When it is terminated and replaced, the liability under that bond for both the importer and the surety is not extinguished by the termination. Depending on the merchandise imported, the liability can remain open for years. Even under the normal liquidation cycle, entries will stay open for 11 months. Now the increased bond is written and there is open liability under that bond also. If this happens multiple times, the principal and surety are fully exposed under all bonds until entries are liquidated. This can cause underwriting concerns for the surety, as the bond is a financial guarantee if the importer defaults.

Importers should know the importance of forecasting the next 12 months of estimated duties, taxes and fees for their imports to determine the proper bond amount going forward. They should take their annual import value and multiply it by the tariff rate for the next 12 months ascertain a bond amount that will be sufficient in the year to come.

With the continuation of these trade remedy tariff rates coupled with the reduction in exemptions, importers likely can no longer look backwards at the last 12 months of duty as it won’t be sufficient until the tariffs have been in place for an entire year. If they obtain a bond large enough to cover their yearly imports and they can avoid multiple bond replacements, and it will save them time, money and frustration.

Planning and Professional Guidance – A Strategy for Success

In conclusion, navigating the complexities of U.S. Customs bonds in the current trade environment requires careful planning, informed decision-making, and collaboration with experienced professionals. As tariffs continue to impact importers, understanding the nuances of bond sufficiency and the potential risks of stacking liability is more crucial than ever. By proactively forecasting future duties and working closely with surety agents and customs brokers, importers can ensure compliance, avoid costly delays, and maintain financial stability. Taking these steps not only safeguards their operations but also positions them for success in an ever-evolving global trade landscape.

For expert guidance and practical solutions, download the “Importer’s Roadmap – Navigating the Challenges of Bond Sufficiency”.

Previously published in the American Association of Exporters and Importers Newsletter.

Disclaimer: This information is provided as a public service and for discussion of the subject in general. It is not to be construed as legal advice. Readers are urged to seek professional guidance from appropriate parties on all matters mentioned herein.