January 04, 2017 | Industry Insights

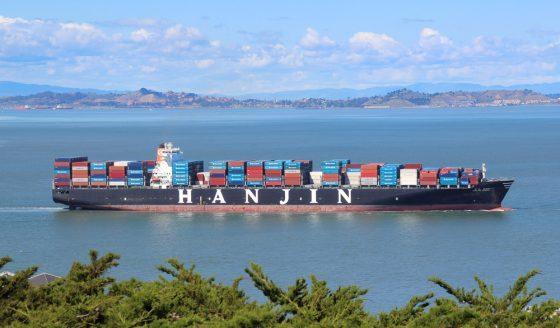

Hanjin Tells Bankruptcy Courts US Liabilities Far Outweigh US Assets

Hanjin Shipping’s US liabilities far exceed its US assets of more than $124 million, the company told a New Jersey bankruptcy court Tuesday amid close scrutiny from a host of US creditors hoping to get paid – including one claiming to be owed $22 million. The troubled container line filed the financial disclosure a day before a US District Bankruptcy Court in New Jersey was scheduled to discuss the ocean carrier’s request to extend a previous Friday deadline to disclose its assets.

Hanjin, which filed for bankruptcy in a South Korean court on Aug. 30, missed the Friday deadline and so sought an extension to Jan. 9. But Judge John K. Sherwood scheduled a hearing on the matter for Wednesday. The hearing comes as Hanjin is seeking to finalize the sale of Total Terminals International, which operates terminals in Long Beach and Seattle and of which Hanjin owns 54 percent.

Also Friday, Hanjin filed papers asking the court to recognize and enforce the sale, which has been approved by the South Korean bankruptcy court. Several logistics and other companies who say they are owed money by Hanjin – among them a container company seeking $22 million in compensation – are closely watching the disclosure process, and several have filed court papers in the past to protect their claims.

Two insurance companies, Continental Insurance Company and Continental Casualty Company, immediately filed papers in opposition to Hanjin’s request for a two-week extension, saying that would give it only three days in which to analyze the documents before Sherwood held a Jan. 12 hearing to determine whether the court would approve the sale or not. “Three business days is simply not enough time for Hanjin’s creditors to review and reasonably evaluate the disclosures,” the insurance companies wrote. Continental Insurance Company and Continental Casualty Company have argued in court papers that their policy holders include companies that provided equipment to Hanjin, who likely will face claims for damage and additional expenses that occurred after Hanjin filed for bankruptcy.

Textainer, the California-based container leasing company, has filed papers to protect potential claims for compensation from Hanjin’s continued use of its containers. TRAC Intermodal, Sea Cube, Home Shopping Network, and OceanConnect Marine have also filed papers in the case.

Source: AIMU Weekly Bulletin